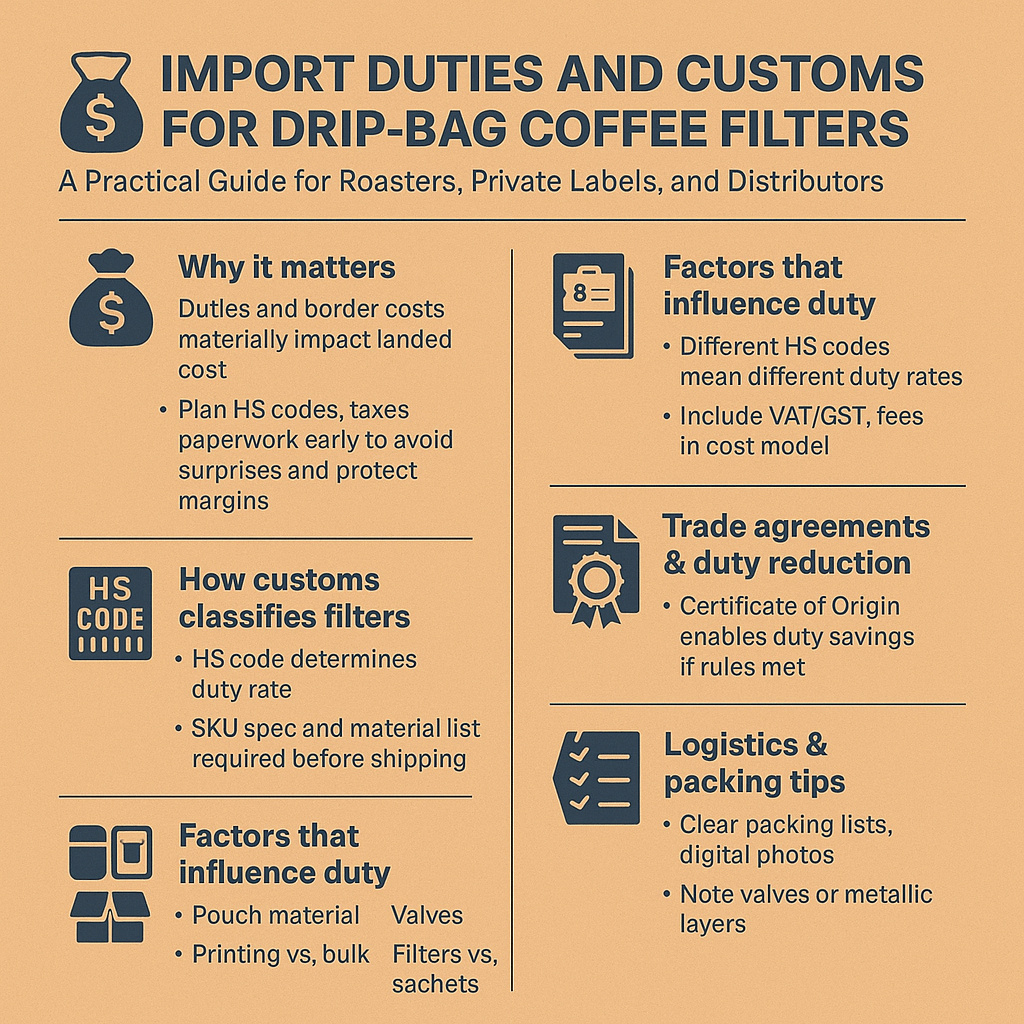

Import duties and associated border costs can significantly impact the landed price of drip coffee filters. For roasters, private label brands, and specialty distributors, planning ahead for customs classification, taxes, and paperwork can help avoid surprises upon delivery and maintain profit margins. Below is a clear, easy-to-understand guide to practical steps to take when importing drip coffee filters, and how Tonchant can support exporters throughout the process.

How customs classify products

Customs agencies use Harmonized System (HS) codes to classify imported goods. The specific HS code that applies to each shipment depends on the product’s construction and intended use—whether it’s filter paper itself, a finished drip filter bag, a bag with a valve, or a packaged retail box—they may fall into different categories. This classification determines the customs duty rate, so an accurate SKU description and bill of materials are crucial before shipping.

Why classification is important for landed costs

Different HS codes mean different tariff percentages. In many markets, switching from a “paper article” heading to a “manufactured article” or “packaged product” heading can result in a tariff increase of several percentage points. In addition to tariffs, you should also budget for VAT/GST, brokerage fees, and any local handling fees. If these post-arrival costs are not included in your landed cost model, they can add up to significantly increase the invoice price.

Common components that affect classification and responsibility

1.Bag or outer bag material (paper, monofilm, foil laminate)

2.Has a one-way exhaust valve or integrated zipper

3.Printed barrier bags vs. unprinted bulk packaging

4.Whether the product is sold in bulk filters or single-serve pouches in retail packaging

Practical Steps to Avoid Customs Surprises

1.Confirm the HS code as early as possible. Provide the customs broker with technical specifications and physical samples so they can recommend the most appropriate classification.

2.Gather origin documentation. Under any applicable trade agreement, a certificate of origin and supporting invoice are required when applying for preferential tariffs.

3.Declare components transparently. List valves, gaskets, printed layers, and adhesives on the commercial invoice so that the classification reflects the overall construction.

4.Consider binding rulings. For new or complex SKUs, apply for a formal customs ruling in the destination market to gain long-term certainty.

5.Budget for VAT/GST and brokerage fees. Customs duties are rarely the only cost at the border – taxes and fees increase landed costs and should be factored into pricing.

How trade agreements and rules of origin reduce tariffs

Preferential trade agreements and tariff concessions can reduce or eliminate tariffs if the rules of origin are met. If your export route qualifies, a properly completed certificate of origin can save you significant costs. Work with your supplier to confirm that the product’s location and production processes comply with the agreement’s rules of origin.

Logistics and packaging tips to reduce border friction

1.Provide clear and detailed packing list and digital photos for customs pre-inspection.

2.Use durable, compact cartons to avoid size surcharge disputes and make shipping costs predictable.

3.If valves or metal layers are present, please indicate this on the paperwork – some markets treat metallized structures differently for tariff and recycling compliance.

How Tonchant helps exporters and buyers

Tonchant prepares complete technical dossiers for each SKU, including material breakdowns, lamination plans, valve specifications, and origin documentation to expedite classification and customs clearance. We can advise on potential HS code ranges, organize certificate of origin documentation where applicable, and coordinate with freight forwarders and customs brokers to ensure fast and reliable customs clearance.

When to consult a customs broker or request a ruling

If your products contain mixed materials (foil + film + paper), special components (valves, stickers, RFID/NFC), or you plan to export in large quantities to multiple countries, consult a qualified customs broker early. To ensure long-term certainty, it’s worth investing in a binding tariff classification or advance ruling in your target market.

A Quick Checklist Before Shipping Drip Bag Filters Internationally

1.Complete a technical specification sheet listing all materials and components.

2.Provide product samples to brokers to obtain HS code recommendations.

3.If you plan to apply for trade preferences, please obtain a certificate of origin first.

4.Confirm VAT/GST processing and brokerage fees at your destination.

5.Verify package dimensions to manage shipping costs and dimensional weight pricing.

Final Thoughts

Import duties on drip coffee filters are manageable with advance planning and proper documentation. Accurate classification, transparent declarations, and the right logistics partner ensure smooth and predictable shipping. Tonchant provides clients with technical documentation, sample packs, and export-specific documents, allowing roasters and brands to focus on roasting, marketing, and sales without worrying about customs issues.

To request a customs-prepared export package or sample kit for sorting and brokerage quotes, please contact Tonchant’s export team with your SKU details and target market.

Post time: Sep-26-2025